Everything You Need to Know (Simple & Clear Guide)

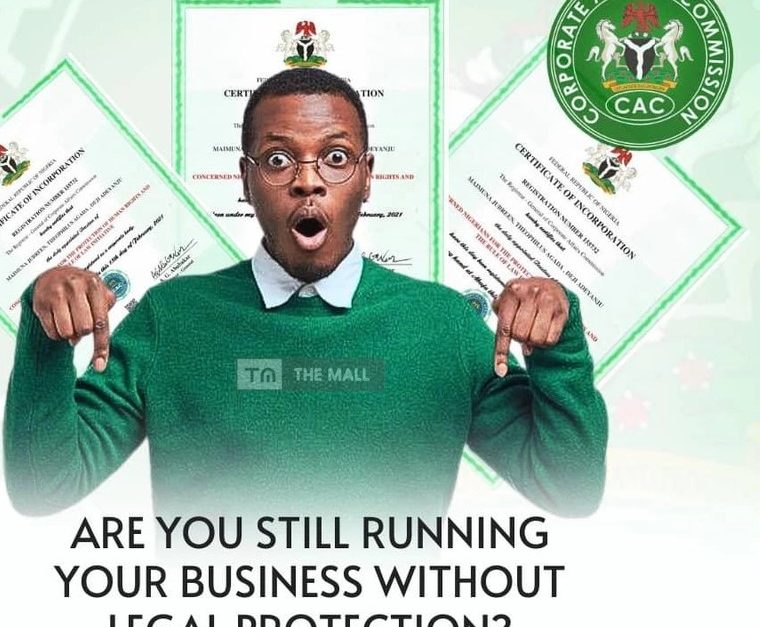

Starting a business in Nigeria is more than just having an idea. To operate legally, open corporate bank accounts, access opportunities, and grow without fear, your business must be registered with the Corporate Affairs Commission (CAC).

This guide explains all types of business registration in Nigeria, why it matters, costs, timelines, and how I can help you handle everything smoothly.

What Is CAC?

The Corporate Affairs Commission (CAC) is the government agency responsible for registering and regulating businesses, companies, NGOs, churches, mosques, and incorporated trustees in Nigeria.

If your business is not registered with CAC, legally, it does not exist.

Why Business Registration Is Important

Registering your business gives you:

-

Legal recognition and protection

-

The right to operate without harassment

-

Ability to open a corporate bank account

-

Access to loans, grants, and funding

-

Trust and credibility with customers

-

Eligibility for contracts and partnerships

-

Tax registration (TIN & VAT)

-

Business continuity and growth

In simple words:

👉 Unregistered businesses struggle. Registered businesses grow.

Types of Business Registration in Nigeria (CAC)

1. Business Name Registration

This is best for small businesses and sole proprietors.

Who it’s for:

-

Small business owners

-

Freelancers

-

Traders and artisans

Examples:

-

Fashion brands

-

Online vendors

-

Consultants

-

SMEs

Key features:

-

Owned by one or more individuals

-

Simple structure

-

Affordable registration

2. Private Limited Liability Company (Ltd)

This is best for growing and serious businesses.

Who it’s for:

-

Startups

-

Tech companies

-

Medium & large businesses

Examples:

-

Tech firms

-

Marketing agencies

-

Construction companies

-

Logistics businesses

Key features:

-

Separate legal identity

-

Owner’s personal assets protected

-

Can attract investors

-

More trusted by banks and corporates

3. Public Limited Company (Plc)

This is for very large businesses.

Who it’s for:

-

Companies that want to raise funds from the public

-

Large enterprises

Key features:

-

Can sell shares publicly

-

Strict regulatory requirements

4. Incorporated Trustees

This is for non-profit and religious organizations.

Who it’s for:

-

NGOs

-

Churches

-

Mosques

-

Foundations and associations

Key features:

-

No profit sharing

-

Operates for social, religious, or charitable purposes

Levels of Business Registration (Simple Explanation)

-

Name Reservation: Checking and reserving your business name

-

CAC Registration: Legal registration of the business

-

TIN Registration: Mandatory tax identification

-

VAT Registration : Required for many businesses

-

Bank Account Opening – Corporate banking setup

-

Compliance & Filings – Annual returns and tax filings

Step-by-Step Process of Business Registration

Step 1: Business Name Search & Reservation

We check availability and reserve your business name on CAC.

⏱ Time: 1–2 days

Step 2: Fill CAC Registration Forms

We prepare and submit all required details.

⏱ Time: 1 to 3 days

Step 3: Payment & Submission

CAC fees are paid and documents submitted.

⏱ Time: Same day

Step 4: CAC Approval & Certificate Issuance

CAC reviews and issues your registration certificate.

⏱ Time:

-

Business Name: 3 to 7 working days

-

Limited Company: 5 to 10 working days

Cost of Business Registration in Nigeria (Estimated)

Business Name Registration

-

CAC fee + processing: ₦15,000 to ₦25,000

Private Limited Company (Ltd)

-

CAC fee + documentation: ₦70,000 to ₦150,000

(depending on share capital)

Incorporated Trustees (NGO, Church, Mosque)

-

CAC fee + publication & processing: ₦150,000 to ₦300,000

💡 Prices may vary slightly based on CAC updates and requirements.

How Long Does Registration Take?

-

Business Name: 3 to 7 working days

-

Limited Company: 5 to 10 working days

-

Incorporated Trustees: 4 to 8 weeks

How to Change a Business Name to Limited Company

Many businesses start small and later want to grow.

Why Upgrade to a Limited Company?

-

Better credibility

-

Access to corporate contracts

-

Asset protection

-

Investor readiness

Process:

-

Register a new limited company.

-

Transfer assets and branding

-

Close or retain old business name

Cost:

-

₦80,000 to ₦150,000 (depending on share capital)

⏱ Time: 5 to 10 working days

Common Mistakes People Make

-

Using the wrong business structure

-

Registering names that can’t scale

-

Skipping tax registration

-

Poor documentation

-

Falling for fake agents

Why Am I In All This? (My Purpose)

I’ve seen too many hardworking Nigerians:

-

Lose contracts

-

Miss funding opportunities

-

Face bank restrictions

-

Get into tax trouble

—all because their businesses were not properly registered or compliant.

My goal is to simplify the process, remove stress, and help businesses start and grow the right way.

Why Choose Me?

✔ I understand CAC processes deeply

✔ I guide you on the right structure, not just registration

✔ I save you time, stress, and costly mistakes

✔ I handle CAC, TIN, VAT, Tax Clearance & filings

✔ I support you beyond registration

I help businesses become compliant, trusted, and ready to grow.

How I Can Help You

I can help you with:

-

Business Name Registration

-

Limited Company Registration

-

NGO / Church / Mosque Registration

-

TIN Registration (Individual & Business)

-

VAT Certificate

-

Tax Clearance Certificate

-

Regular Tax Filing & Compliance

-

Business upgrade from Name → Ltd

Note:

Registering your business is not a luxury, it’s a foundation.

If you want peace of mind, credibility, and growth, start right.

Comments (2)

Narelle Pamuk

The intruders chased the girl in the house and threatened her when she hid from them, according to the PSNI to Limavady Facebook page.

Paul Miller

It’s no secret that the digital industry is booming. From exciting startups to need ghor fore global and brands, companies are reaching out.