What It Really Means for You, Your Business & the Economy

1. What Is the New Tax Policy?

On January 1, 2026, Nigeria will introduce the biggest update to its tax system in decades. The government passed four new tax laws in 2025 that replace many old, outdated tax laws with a modern system meant to make taxation simpler, fairer, and easier to comply with. (PwC)

Instead of many separate tax laws for VAT, income tax, capital gains tax, stamp duty, etc., there will now be a single, harmonized tax framework that applies to both individuals and businesses.

2. Why the Change Is Important

Simplicity & Clarity

The old system had overlapping rules and confusion between federal, state, and local tax requirements. The new tax framework removes these overlaps and makes compliance clearer for taxpayers.

Fairness & Relief for Low Earners

One of the key goals is tax relief for most Nigerians. Government estimates indicate that about 98% of Nigerians will either pay less tax or none at all under the new rules. Low earners, including many middle-income workers, benefit most.

Boosting Revenue for Public Services

While many pay less tax, the system still ensures government revenue remains strong to fund schools, hospitals, roads, jobs, security, and other public services, which are especially important as Nigeria’s economic growth targets rise.

Where To Register TIN Near Me

Where To Register Tax In Lekki Ajah Sangotedo Lagos Nigeria

3. Key Changes You Should Know (Simple Breakdown)

Individuals & Workers

Low-income tax relief: People earning ₦800,000 a year or less pay no income tax at all.

Progressive tax rates: Higher earnings are taxed progressively (higher earnings pay higher percentages).

Rent relief: Instead of old allowances, a new rent relief allowance exists to reduce taxable income (up to 20% of rent paid).

Everyone must file a return: New rules require most people to register with the tax authority and file annual returns.

Tax Identification Number (TIN): Every taxpayer must have a TIN, even if you have a bank account used for income or business. (Some banks are already warning customers they will restrict accounts that aren’t linked to a TIN starting Jan. 1, 2026).

Businesses & Companies

✔ Small business tax relief: Businesses with less than ₦100 million turnover annually and relatively small assets are exempt from corporate tax, capital gains tax, and a newly introduced development levy.

✔ Lower rates for larger companies: Companies above this threshold now pay corporate tax at a reduced rate of roughly 25% (down from around 30%).

✔ Development levy of 4%: Larger, more profitable companies will pay this on assessable profits, replacing some older fees combined into one.

✔ VAT remains but with exemptions: VAT stays at 7.5%, but essential goods and services like food, education, healthcare, rent, and public transport are exempt or zero-rated to reduce the cost burden.

✔ Digital services & foreign platforms: Non-resident digital services (like streaming or foreign digital suppliers) will face defined VAT obligations under the new law.

4. What Benefits This Brings

For Ordinary Nigerians

✔ Many will pay less or no tax

✔ Essential items (food, rent, transport, healthcare) are VAT exempt

✔ Easier and simpler filing

✔ The tax system now clearer and more predictable

For Small & Medium Businesses

✔ Relief and tax breaks to reduce costs

✔ Easier registration and compliance paths

✔ Encourages formal business registration

✔ Lower corporate tax rate than before

For Government & Economy

Broader tax base (more people filing returns)

Reduced tax evasion and improved transparency

A more stable system to fund public services

Easier collection and enforcement via unified systems

5. What You MUST Do Before 2026

For Individuals

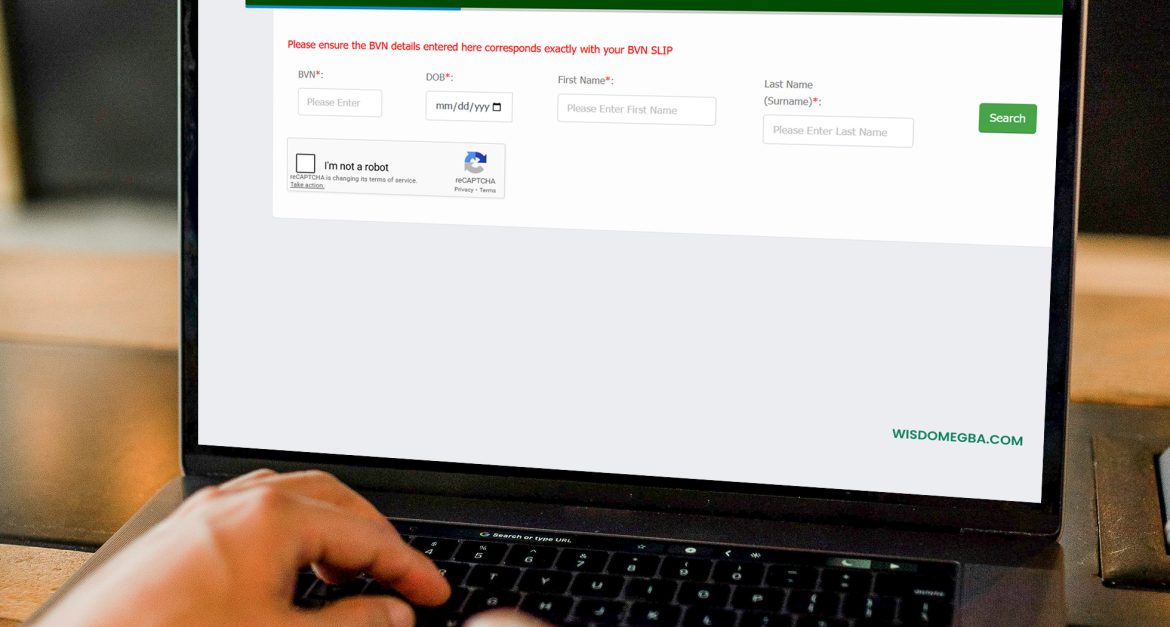

🔹 Register for a Tax Identification Number (TIN)

🔹 Prepare to file annual tax returns even if you earn from multiple sources

🔹 Understand your tax band and how rental relief applies

TIN

For Businesses

🔹 Register your business with the tax authority

🔹 Get a TIN for the business (different from personal TIN)

🔹 Obtain a VAT Registration Certificate (if required)

🔹 Ensure tax compliance with digital filings, TIN linkage, and proper bookkeeping

🔹 Prepare for the new development levy and corporate tax thresholds

6. Common Mistakes People Make (and How to Avoid Them)

❌ Not registering for a TIN early will delay bank operations and filings.

❌ Assuming old tax rules still apply, 2026 changes are significant

❌ Waiting until the last minute to file returns to avoid penalties for late filing

❌ Not understanding VAT exemptions essential items are exempt, but most goods are still taxable

7. Penalties for Non-Compliance (Important!)

New rules have stronger fines for failure to:

Register for tax.

File returns.

Keep financial records.

Provide accurate tax information.

Fines can include monthly penalties starting from tens of thousands of naira, escalating for continuous non-compliance.

8. How I Can Help You (Step-by-Step Support)

You don’t have to do this alone.

Register Your TIN (Individual or Business)

I will walk you through every step and ensure your TIN is issued correctly.

Register Your Business with the Tax Authority

I help formalize businesses so they can operate legally and benefit from tax relief.

Get Your VAT Registration Certificate

If you sell goods or services requiring VAT, I will help you register and stay compliant.

Obtain Your Tax Clearance Certificate

I prepare and submit your documents so you can get clearance when needed.

Do Regular Tax Filings

Monthly/quarterly/annual filing can be confusing. I do it for you accurately and on time.

NEW TAX POLICY IN NIGERIA 2026

9. Why You Need Me

Many people struggle with tax because:

Laws are complex

Requirements keep changing

Government systems are unfamiliar

Mistakes lead to fines

I make it simple.

I help you understand what to do, why it matters, and how to comply without stress. I handle the paperwork and filings so you can focus on your business.

10. Conclusion

The 2026 tax reforms are not just new rules; they are a transformation of how Nigeria taxes people and businesses. They bring relief for many but also new responsibilities. If you prepare early, understand the requirements, and stay compliant, you will save money, avoid fines, and position your business for growth.